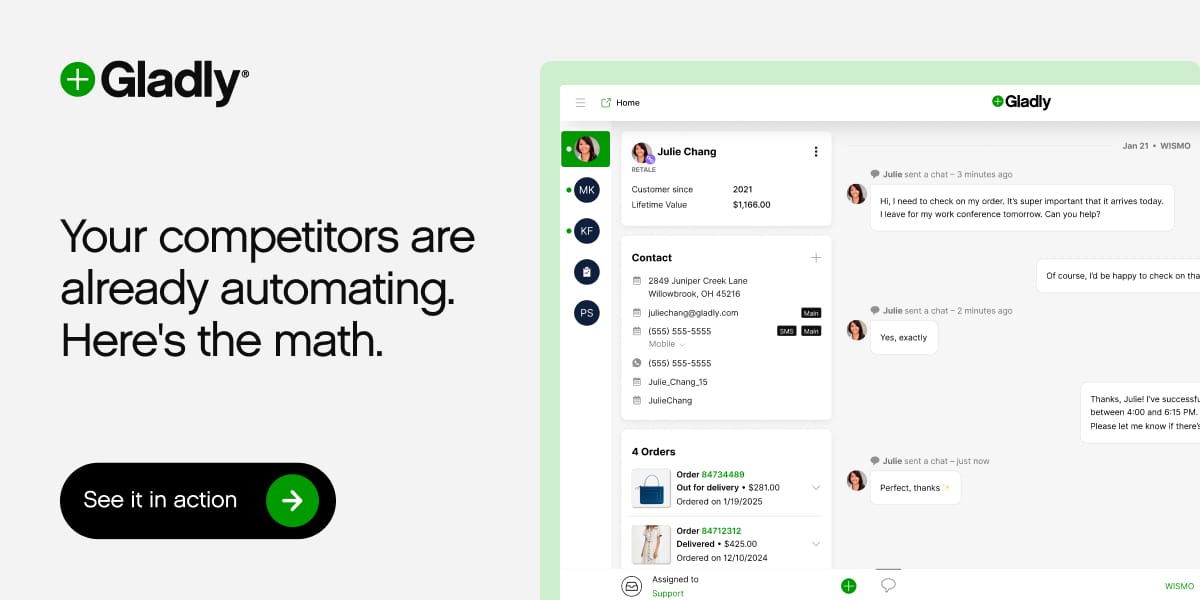

Your competitors are already automating. Here's the data.

Retail and ecommerce teams using AI for customer service are resolving 40-60% more tickets without more staff, cutting cost-per-ticket by 30%+, and handling seasonal spikes 3x faster.

But here's what separates winners from everyone else: they started with the data, not the hype.

Gladly handles the predictable volume, FAQs, routing, returns, order status, while your team focuses on customers who need a human touch. The result? Better experiences. Lower costs. Real competitive advantage. Ready to see what's possible for your business?

💸 Interesting Tech Fact:

Would you believe that in the early 1800s, some European banks experimented with mechanical cipher wheels embedded directly into paper currency to prevent counterfeiting? This was definitely an early fusion of cryptography and money long before computers existed. These rotating symbol systems required matching physical keys held by banks, making duplication nearly impossible at the time. While short-lived due to manufacturing complexity, they quietly introduced the idea that currency security could be dynamic, not static — a principle that still underpins modern digital asset protection today 🔐📜.

Introduction

Cryptocurrency was never just about money. It was about control, autonomy, and the promise that technology could replace fragile institutions with resilient code. Yet as the ecosystem has matured, it has inherited something far older than blockchains themselves: human error, overconfidence, hidden dependencies, and invisible chains of trust. The modern cryptocurrency breach is rarely a single dramatic failure. It is almost always the result of multiple small decisions compounding quietly until the damage becomes unavoidable.

These types of security incidents are not isolated anomalies. They are signals. Each breach reveals where incentives, architectures, and behaviors drifted out of alignment. In crypto, this misalignment is amplified because assets move instantly, attackers operate globally, and reversibility is largely a myth. When something breaks, it does not leak slowly. It spills.

This article examined the primary types of cryptocurrency cybersecurity breaches, how they unfold in practice, and why they continue to succeed despite years of warnings. It also integrated a current, real-world example — the Ledger customers impacted by the Global-e third-party data breach — not as an outlier, but as a symptom of a deeper structural problem. What follows is not alarmist. It is descriptive, grounded, and unapologetically direct.

Exchange Compromises and Hot Wallet Exploitation

Centralized exchanges remain one of the most attractive targets in the cryptocurrency ecosystem. They aggregate vast sums of digital assets, operate continuously, and often balance usability against security in ways that create exploitable gaps. Hot wallets, by design, are connected to the internet. That connection is the price of liquidity — and the cost of exposure.

In many exchange breaches, attackers do not “hack crypto” in the abstract. They compromise credentials, exploit poorly segmented infrastructure, or leverage unpatched systems to gain access to wallet management layers. Once inside, the mechanics are brutally simple. Funds are transferred, often broken into fragments, routed through mixers or cross-chain bridges, and effectively gone within minutes. The blockchain records everything, but records do not equal recovery.

What makes these breaches particularly damaging is not just the financial loss, but the erosion of confidence. Users are reminded that custody is a delegation of trust, not its elimination. Even exchanges with strong branding, compliance frameworks, and public security postures can fail under pressure if operational discipline weakens. The lesson is consistent: aggregation increases efficiency, but it also magnifies blast radius.

Smart Contract Vulnerabilities and Logic Failures

Smart contracts are often described as immutable, but immutability only preserves what was written — not what was intended. A significant class of cryptocurrency breaches stems from logic flaws embedded directly into contract code. These are not always obvious bugs. Many are edge cases, rounding errors, flawed assumptions about transaction ordering, or poorly understood interactions between contracts.

Attackers specializing in decentralized finance spend less time breaking cryptography and more time reading code with adversarial intent. They simulate conditions developers did not anticipate, exploit re-entrance paths, manipulate oracle inputs, or abuse permission models that were assumed to be benign. Once triggered, these exploits execute exactly as programmed, draining liquidity pools or minting unauthorized assets without violating any syntactic rules.

The uncomfortable reality is that many of these failures are not due to lack of intelligence, but lack of restraint. Rapid deployment cycles, competitive pressure, and the illusion that audits equal safety all contribute. Code becomes law only after it becomes liability. And once deployed, remediation often requires social coordination, forks, or emergency governance actions that contradict the very ideals decentralization was meant to uphold.

Phishing Campaigns and Identity-Focused Attacks

Not all breaches require technical sophistication. Some require only persuasion. Phishing remains one of the most effective attack vectors in cryptocurrency because it targets the most complex component in any system: the human being operating it. Wallet approvals, seed phrases, and signing prompts create opportunities for deception that are difficult to eliminate without sacrificing usability.

Modern crypto phishing is highly contextual. Attackers clone legitimate interfaces, mirror real transaction flows, and time their outreach around market events, airdrops, or protocol updates. Victims are not careless; they are overloaded. One mistaken signature can authorize a malicious contract to drain assets without further interaction.

What elevates phishing from nuisance to systemic threat is scale. Automated tooling allows attackers to target thousands of users simultaneously, adapting lures in real time. Losses are fragmented across individuals, often going unreported, yet cumulatively massive. In an ecosystem where self-custody is celebrated, the burden of vigilance is relentless — and attackers exploit that fatigue mercilessly.

Bridge Attacks and Cross-Chain Weak Points

Cross-chain bridges were built to solve fragmentation, but they have introduced some of the most catastrophic failures in crypto history. These systems hold or mirror assets across chains, relying on complex validation mechanisms, multi-signature schemes, or centralized re-layers. Each additional abstraction layer becomes another opportunity for misconfiguration or compromise.

Bridge attacks often succeed because they sit at the intersection of multiple trust domains. Validators may be compromised, signing keys leaked, or governance processes abused. In some cases, attackers do not even need to breach cryptography; they exploit operational shortcuts taken to improve speed or reduce costs. Once a bridge is compromised, the attacker effectively prints money on the destination chain.

The broader implication is sobering. Interoperability increases composability, but it also creates systemic coupling. A failure in one protocol can cascade across ecosystems, impacting users who never directly interacted with the vulnerable system. This is risk propagation at protocol speed, and it remains poorly understood outside specialist circles.

Third-Party Supply Chain Failures in Crypto Infrastructure

One of the most underestimated threats in cryptocurrency security is not on-chain at all. It lives in payment processors, analytics platforms, customer support systems, and marketing infrastructure. The recent exposure of Ledger customer data through its third-party partner Global-e illustrates this risk with uncomfortable clarity.

Ledger’s core product — hardware wallets — is designed to minimize digital exposure. Private keys never leave the device. Transactions are verified physically. Yet customers were still impacted because identity data does not live on a blockchain. Names, email addresses, purchase histories, and shipping details reside in conventional systems, often managed by vendors outside the primary organization’s direct control. When those vendors fail, the downstream consequences are real.

This type of breach does not drain wallets directly, but it sets the stage for more dangerous attacks. Exposed customer data fuels targeted phishing, social engineering, and impersonation campaigns. Attackers gain context, credibility, and timing. The lesson is blunt: security boundaries are only as strong as the least scrutinized dependency. Crypto companies may decentralize assets, but their operations remain deeply centralized — and attackers know exactly where to look.

Insider Threats and Privileged Access Abuse

Not every breach comes from the outside. Insider threats, whether malicious or negligent, continue to play a significant role in cryptocurrency incidents. Developers with privileged access, operations staff managing keys, or contractors handling deployments can introduce risk intentionally or inadvertently. The more complex the organization, the harder it becomes to enforce strict least-privilege controls.

In some cases, insiders exploit their access directly, siphoning funds or leaking sensitive information. In others, they become unwitting conduits — reusing passwords, falling for spear-phishing, or bypassing controls to meet deadlines. The narrative often frames these incidents as betrayals, but they are frequently symptoms of weak governance and poor separation of duties.

Crypto’s culture of speed and innovation can unintentionally normalize risky behavior. When launch timelines are celebrated more than control rigor, safeguards erode. Trust becomes implicit rather than engineered. And implicit trust is exactly what adversaries exploit.

Why Crypto Breaches Keep Working

The persistence of cryptocurrency breaches is not due to ignorance. It is due to misaligned incentives and incomplete threat models. Security is often treated as a feature rather than a condition. Audits are seen as milestones instead of ongoing processes. And responsibility is frequently diffused across users, protocols, and partners until accountability becomes abstract.

There is also a deeper tension at play. Crypto systems aim to remove intermediaries, yet they rely on layers of tooling, services, and governance structures that reintroduce them in subtler forms. Each layer promises efficiency while quietly accumulating risk. Breaches occur where visibility fades and assumptions harden into dogma.

Ultimately, attackers succeed because they adapt faster than defenses mature. They do not need perfection. They need one overlooked permission, one rushed integration, one vendor trusted by default. And in a system designed for irreversible transactions, that is often enough.

Six Patterns That Appear Across Nearly Every Major Crypto Breach

Over-reliance on assumed trust rather than continuously verified trust

Excessive privilege concentrated in keys, contracts, or personnel

Third-party services treated as operational conveniences instead of risk multipliers

Security controls designed for compliance optics rather than adversarial pressure

User experience optimizations that obscure meaningful consent or risk

Incident responses that prioritize narrative control over structural correction

The Reshaping of Digital Money Through Repeated Breach Cycles

The accumulation of cryptocurrency breaches is actively reshaping how digital money will evolve, not by weakening it outright, but by forcing a reckoning with how trust is constructed and maintained. As these incidents become more visible, future crypto systems will place less emphasis on ideological purity and more on provable resilience. Architectural decisions will increasingly prioritize compartmentalization, reduced dependency chains, and friction where it meaningfully lowers risk. This shift will likely slow certain forms of innovation, but it will also mature the ecosystem by discouraging designs that rely on blind confidence rather than verifiable safeguards.

At the same time, repeated breach cycles will recalibrate user expectations. Convenience-first models that obscure risk will steadily lose credibility, while platforms that surface accountability, transparency, and failure boundaries will gain traction. Trust will no longer be implied by branding, decentralization claims, or technical jargon. It will be earned through demonstrated restraint, operational discipline, and the visible ability to absorb shocks without cascading harm. In this future, digital money will not be defined by the absence of intermediaries, but by the quality of the structures that quietly stand between users and irreversible loss.

Final Thought

Cryptocurrency breaches are often framed as technical failures, but they are more accurately failures of coherence. Systems fail when their values, architectures, and incentives drift out of alignment. The Ledger and Global-e incident did not undermine cryptography, but it did undermine the assumption that strong core design alone is enough. It is not.

As digital money continues to integrate with everyday commerce, its attack surface will expand beyond block explorers and into logistics, identity, and human behavior. The question is no longer whether breaches will occur, but whether organizations and users are willing to confront where their real dependencies lie. Security in crypto is not a destination. It is a discipline that must extend beyond code, beyond chains, and beyond comforting narratives about decentralization. Those who fail to internalize this will continue to learn the same lesson — repeatedly, publicly, and at increasing cost.

Subscribe to CyberLens

Cybersecurity isn’t just about firewalls and patches anymore — it’s about understanding the invisible attack surfaces hiding inside the tools we trust.

CyberLens brings you deep-dive analysis on cutting-edge cyber threats like model inversion, AI poisoning, and post-quantum vulnerabilities — written for professionals who can’t afford to be a step behind.

📩 Subscribe to The CyberLens Newsletter today and Stay Ahead of the Attacks you can’t yet see.